Many parents are concerned about the pension landscape that will exist when their children come to retire. In the future, their children may not be able to rely on generous State provision or tax incentives that exist today.

At present, it is not possible in Ireland to establish a pension for a child unless the child becomes an employee of the family business, and the tax reliefs available for contributing to your own pension are not extended to your child.

Table of content

Investing for your children

If you wish to invest money on behalf of a child or give an asset to a child to use when they are older, then a bare trust is a means to do so. The beneficiary may then choose to use the gift for fees for their retirement, their education, to set themselves up in a business, or for a house deposit, for example.

As an alternative to a pension, a bare trust is a tax efficient way to give a gift of money, or an asset such as property or company shares, to someone who is under 18 as it utilises Capital Acquisitions Tax tax free thresholds and the Small Gift Exemption in giving the gift.

What is a bare trust?

A trust is, essentially, where assets are held by trustees for the benefit of another. The settlor gloves a gift of money, property, or company shares to the beneficiary who then becomes the legal owner of the asset.

A bare trust can be set up by someone, for example a grandparent, who wishes to provide for a child, their grandchild, when they are an adult. The settlor pays the gift to a trust fund which is managed by one or more trustees on behalf of the beneficiary of the trust (the child).

Once the gift is given, the money asset legally belongs to the beneficiary of the trust, the child, but is held and managed on their behalf by the trustees.

The settlor, in this example the grandparent, can be a trustee and has control over how the money is invested. Usually the child’s parent(s) would also be trustees.

How to set up a bare trust

One way to set up a bare trust for a child as a tax efficient way to provide for them in the future is in conjunction with a life insurance savings and investment plan.

A life insurance savings or investment plan allows you to invest a lump sum or smaller incremental amounts in a fund provided by the life insurance company and managed by a fund manager on your behalf.

Most life insurance companies allow you to choose how your money is invested and the level of risk and potential returns that you are comfortable with.

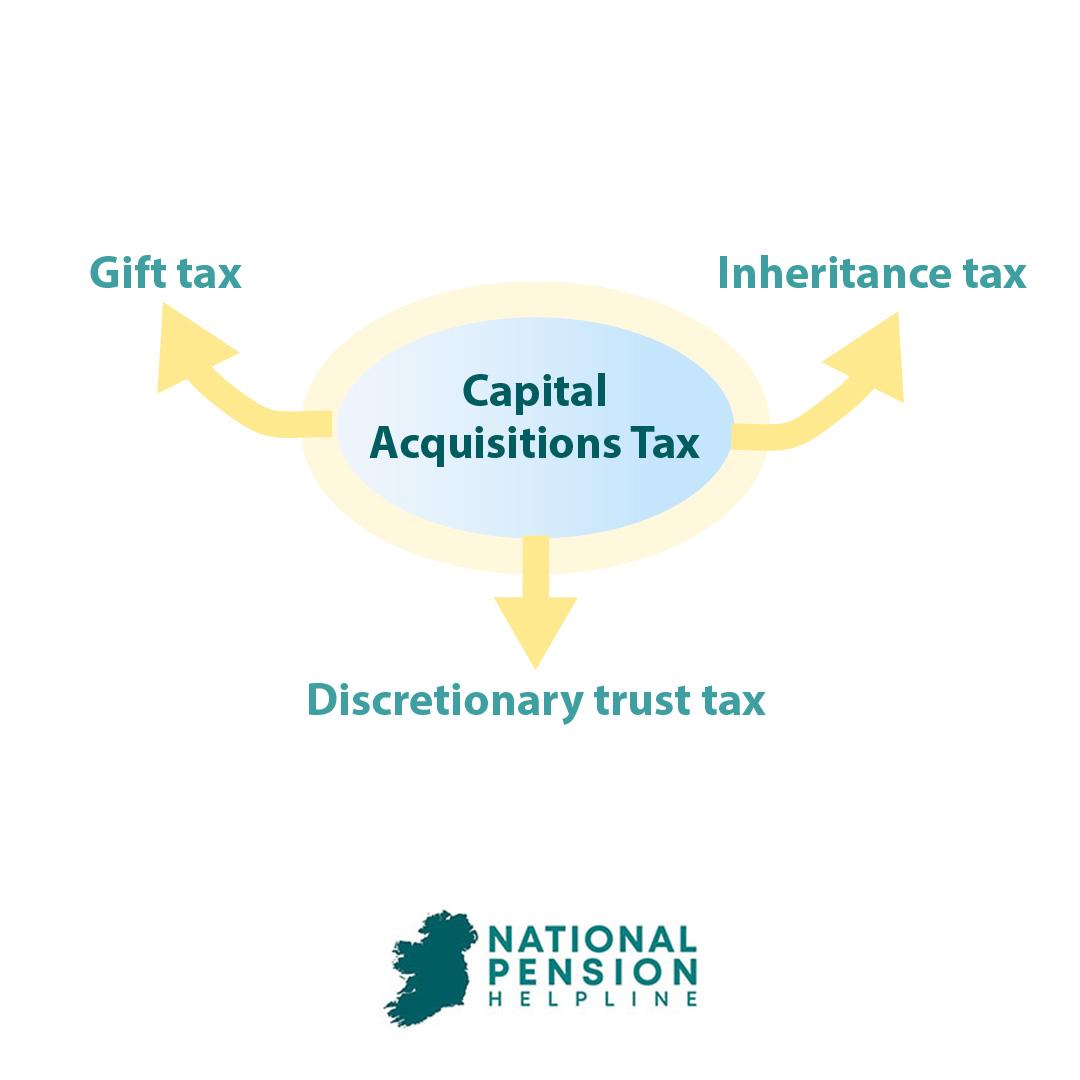

Capital Acquisitions Tax

Capital acquisitions tax comprises three forms of tax:

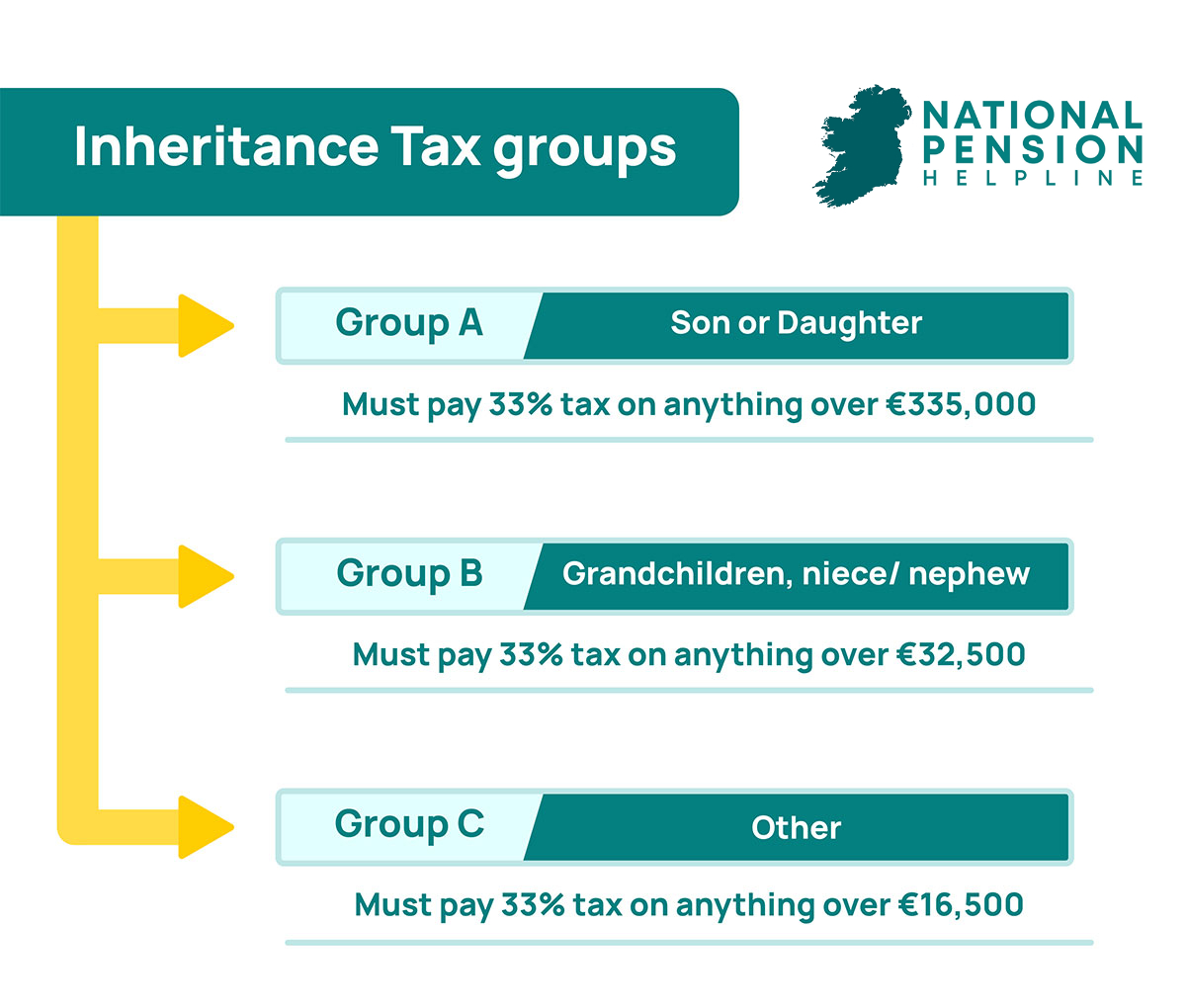

Gift tax liability thresholds vary according to the relationship between the person giving the gift or inheritance and the beneficiary of the gift or inheritance.

| Group A | €335,000 | Applies to a child, stepchild or foster child of the disponer (giver). |

| Group B | €32,500 | Applies to brother, sister, parent, grandparent, niece, or nephew. |

| Group C | €16,250 | Applies to any other relationship. |

Any gifts given since 5th of December 1991 within the same group threshold are combined.

If the gift(s) you receive is below the threshold for your relationship with the person who has given you the gift(s), then you are not liable for tax on that gift(s). If, however, the gift you receive is above the threshold, then CAT of 33% is charged on amounts above the threshold only.

CAT Small Gift Exemption

With the Small Gift Exemption, gifts of up to €3,000 can be given in each calendar year by any person to another and are exempt from CAT.

The Small Gift Exemption is a way of planning in the longer term to provide regular gifts for those who you wish to benefit from your assets.

You can use the Small Gift Exemption as a tax efficient way to contribute to a bare trust for someone who is under 18. In this way parents, grandparents, and others who wish to do so can contribute to the trust for the child, provided the gifts are below the threshold for the Small Gift Exemption.

Advantages of a bare trust

Setting up a bare trust to invest for children has several advantages:

Disadvantages of a bare trust

A bare trust has many advantages, however there are a few points to be aware of.

A bare trust can only be set up to benefit a child who is under 18. If you wish to give a gift of money to someone over 18, a bare trust cannot be used.

It is also important to be certain that you will not need access to the money in the future as the money put in trust for the beneficiary legally becomes the owner of the assets. The bare trust cannot be revoked in the future.

Where to find pension information

The National Pension Helpline is a reliable, free, source of information about pensions and providing for your retirement.

If you are concerned about pensions for your child, grandchild, niece, nephew, or godchild or you wish to provide for a child, then the National pensions helpline can offer you advice and information.

Fill out our assessment form or call us and a qualified advisor will contact you to explore your options. We offer free consultation with qualified pension advisors so that you can set a child on the road to planning for their future and retirement.