Table of Contents

Introduction

Inheritance tax (also known as capital acquisitions tax) is billed against the value of anything that you might inherit from a family member, such as a parent.

It affects everyone, not just the wealthy, and this is because there is a relatively low threshold applied when the tax is triggered.

The tax threshold is €335,000. Given that the most common inheritance is in the form of property, many people irrespective of their supposed wealth, will be faced with inheritance tax and hit this threshold quite quickly.

However, there are things that can be done now to manage how much tax your children or other beneficiaries will have to pay on their future inheritance.

The first step is to begin to understand the inheritance tax structure, how it affects different kinds of family members and how being a beneficiary to an estate, no matter how small or large, is controlled.

What is Capital Acquisitions Tax (CAT)?

The correct term for inheritance tax is Capital Acquisitions Tax (CAT) and in Ireland this tax is set at 33%. It is a tax on gifts and inheritance.

The amount of your inheritance that will be taxed is triggered when the value of your inheritance goes over the CAT threshold – €335,000.

If you inherit a property, for example, you will not have to pay tax on the full value of that property. You will only be taxed on the amount of the property’s value that is over the €335,000 threshold.

So if a property is worth €500,000 you will be taxed on the portion above the threshold – €165,000. The rate of tax that you will have applied to this portion is 33%. This is called Capital Acquisitions Tax (CAT).

It is applied to two areas:

Gift tax

This is a tax on gifts that you receive from a parent, for example. You will be taxed on anything with a value over €3,000. You will receive an exemption when the gift is not over this value threshold.

CAT (capital acquisitions tax) is the term generally used for gift tax.

Inheritance tax

This is a tax on gifts or inheritance received after someone has died. This applies to both cash and assets.

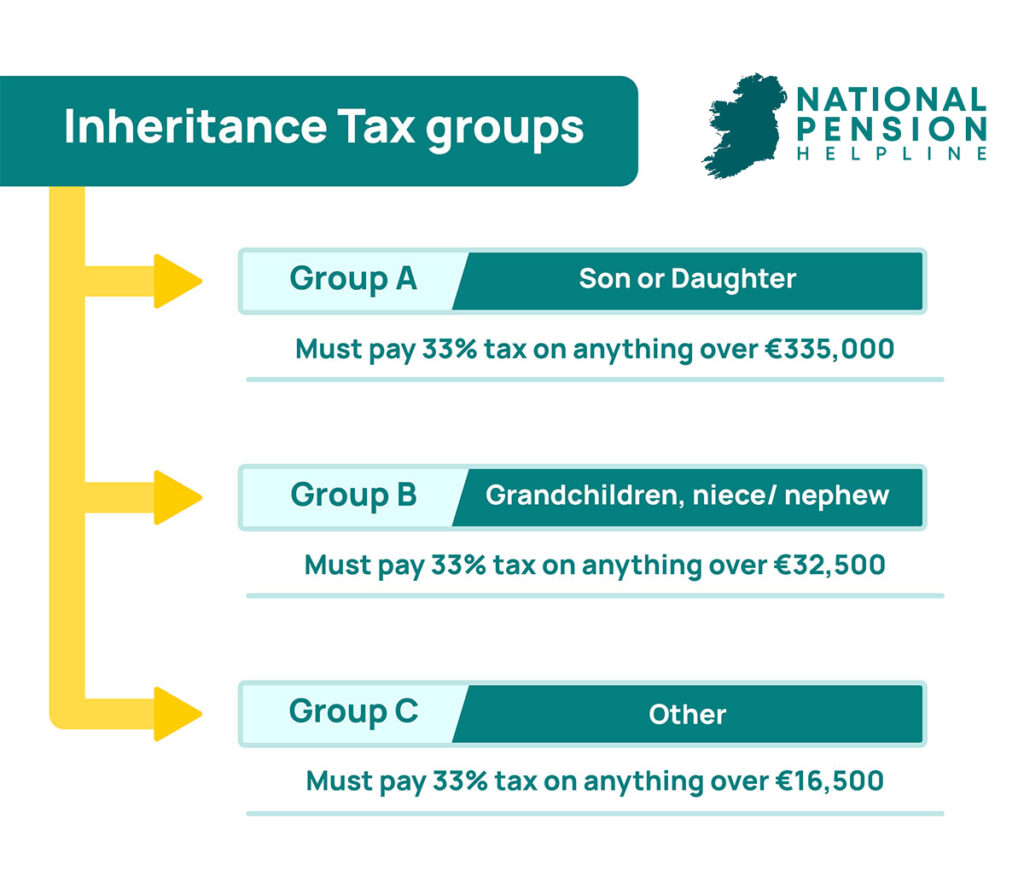

Inheritance tax groups

There are three tax groupings under the inheritance tax system that you need to be aware of when calculating how much inheritance tax you must pay. Each has their own tax free threshold and implication, depending on which group you fit into.

Group A €335,000

Group B €32,500

Group C €16,250

Inheritance tax Group A: Sons and daughters

These beneficiaries must use the €335,000 tax free threshold when calculating their tax requirement. It includes adopted children, step-children and in some cases fostered children.

If a child dies and their estate is inherited by their parents then this is also the threshold grouping that will apply for tax purposes.

This group also includes certain foster children who were under the fosters families care before the age of 18.

Inheritance tax Group B: family connections

This group includes any family connection such as a brother or sister, a niece or nephew, a grandparent or grandchild, or any other familial descendent of the person whose estate is being disposed of. Group B has a tax free threshold of €32,500.

Inheritance tax Group C: Other

This group refers to all other family or dependent connections which do not fall under group A or B. Group C has a tax free threshold of €16,250.

Once you are clear on which group you fall into then you will be able to calculate the inheritance tax threshold that applies to you. The largest group of people are in Group A as this is the most common inheritance scenario – from parent to child or vice versa.

What happens if I already received an inheritance?

Inheritance tax is calculated based on all your lifetime inheritance. So for example, if you inherit €500,000 from one parent and then subsequently receive a second inheritance valued at €500,000 from a second parent, the two amounts are considered to make up your tax threshold.

You will already have used your €335,000 tax free exemption on the first inheritance and consequently you will be obliged to pay tax at 33% on the full amount of your second inheritance.

On the other hand, the small gifts thresholds of €3,000 reset each year so you could receive a tax-free gift of up to €3,000 each year.

What is Estate Planning?

Estate planning is the process of managing how your wealth will be inherited by your children or other dependents. It is considered a prudent approach to managing the tax implications of a handover of monetary value such as an inheritance.

A legal spouse or civil partner does not have to pay tax on their inheritance from their spouse. This is a tax-free transfer of wealth or estate between two people.

Parents or grandparents, on the other hand, will have dependents who will be obliged to pay an inheritance tax bill so they can begin to manage this inheritance at any stage of their life.

For example, a grandparent may choose to make an annual deposit into an account for a grandchild of €3,000.

As the tax threshold for small gifts such as this resets every year the recipient will not have to pay tax on the final amount. Over 20 years this can grow to €60,000 tax free.

It is a very common and efficient way to transfer wealth between family members while reducing the tax implications for the recipient.

Inheritance tax relief

Depending on a person’s circumstances, there are various tax relief options available that should be considered by the person transferring their estate or potentially receiving it.

Speak with a trusted financial advisor to see if you qualify for Inheritance tax relief.

Dwelling house exemption

For those people who are inheriting the family home of a person who has died there are some exemptions.

For example you will not have to pay tax on the value of a home that you currently live in and intend to continue to live in. But this is not a limitless scenario. There are restrictions.

Business Inheritance relief

Business inheritance, such as a pub or another family business, also qualify for tax relief if they come under certain stipulations.

For example, a parent can transfer ownership of a business to a child under strict rules. Business relief reduces the taxable value of the business which is used to calculate capital acquisitions tax by 90%. A number of conditions need to be set however.

These conditions include things like how long the person has been involved with the business, the familial connection, the length of time they plant to remain in the business afterwards, as well as others.

There is the opportunity for clawback of value if these conditions are not met so if you find yourself with a business to gift or to receive then ensure that you access expert advice on how to manage this important transaction.

Agricultural Inheritance Relief

The transfer or inheritance of an agricultural property such as a farm can also qualify for tax exemption if it meets certain criteria. As with the business relief, this exemption can extend to 90% of the taxable value of the estate.

To trigger this exemption the property must be or have:

The value of the total property should hold 80% of its value in land, not the dwelling house.

Favourite Niece / Nephew

In specific situations a nephew or niece can be transferred to the Group A scenario so that they can benefit from the €335,000 tax free threshold.

These include where there are no children of the parent who has died and other specific situations. If you consider yourself to be in this situation consult an expert advisor to help you manage your tax exemptions.

Other tax exemptions

There are additional scenarios where a gift or an inheritance can be made to a person without the full tax implications being levied. These include situations such as:

How to cover the cost of inheritance for your loved ones?

What is a Section 72 policy?

New solutions exist for people who are managing their wealth and wish to ensure that the transfer of a property or other inheritance is done in the most tax-efficient way.

For example, if you were to inherit a house in Dublin there is every likelihood that it could be valued at over half a million euro.

If this is the case the inheritance tax on this could be very high. If you don’t have the money to pay this tax you will be obliged to sell the property simply to pay the tax on the inheritance.

If the property is your family home you may not want to sell it but without the cash to pay the tax bill you will have no choice.

For this reason some people choose to take out an insurance policy called a Section 72. This is a policy that pays out on death so that your dependents do not have to worry about the tax implications of the value of a property.

You pay into the policy monthly as per any other insurance policy and when you die the proceeds of this policy are used to pay any tax bill that arises through inheritance.

It is similar to a life insurance policy but unlike the value of a life insurance policy which will be taxable when transferred as part of an inheritance, the Section 72 policy is tax exempt. Therefore the full value of the policy is available for tax bill purposes.

To qualify for a section 72 you must begin the process of paying into it monthly before the age of 75 and you must continue to pay into it until you die. If you stop for any reason the policy becomes void.

What is the difference between a Section 72 policy and a standard life cover policy

The value of a life insurance policy falls under the same inheritance tax scenario as any other part of a person’s estate. The recipient of the value of the policy will have to pay tax on this once it and the rest of the value of the estate crosses the €335,000 tax free threshold. This will be taxed at 33%.

In the case of a section 72 policy you will not be taxed. The full 100% value of the Section 72 pay-out is available to pay tax bills accrued by an inheritance recipient.

Do I pay inheritance tax on property in another country?

Various tax scenarios exist around the ownership of property in other countries and how they are inherited.

For example, it is fairly common for an Irish person to own holiday property abroad – an apartment, a villa or some other property type. If this becomes part of an estate the value of this property is included but you may need to pay that tax in the other country as well as in Ireland.

This is a very complicated and tax hazardous situation that requires expert assistance from an advisor. Various tax treaties exist between Ireland and other countries, such as the US or the UK. They allow you to claim a credit against capital Acquisitions Tax if you have paid tax on a foreign property.

Inheriting property in the USA

The United States is one country that has an agreement with Ireland around tax implications of inheriting property there.

It reflects the long history of Irish people in the United States and the fact that many people own property there, either domiciled or non-domiciled.

You will only be charged tax on property located abroad if the person who gives you the inheritance is domiciled in Ireland or is a non-US resident in the United States.

Inheriting property in the UK

The situation in the UK is different primarily because of the different ways that the Irish and UK authorities decide who is liable for tax and how.

For example, inheritance tax in Ireland is based on the residence of the person who died or the beneficiary. In the UK the tax is based on the domicile of the person involved.

The domicile is the place that the individual considered home. This can cause complications around what the definition of home is and the way in which it is recognised.

If you are involved in an inheritance of a property in the UK then it is advised to take expert legal advice to help you avoid double taxation – once in each country.

A tax specialist can help you determine your options and how best to treat this inheritance in a way that will be most beneficial to the recipient.

What happens to your pension if you die?

This is a complicated but very important area. Your pension pot is likely to be your next largest asset after your home value.

The way in which it is passed to a beneficiary and how much tax they will pay will largely depend on many aspects, including the rules of your pension and who qualifies as a dependent, whether you are already retired or still in service and which group of CAT the recipient is in.

The normal rules of inheritance tax will apply including the tax free threshold of €335,000 for anyone in group A.

How do I pay my inheritance tax

You pay your inheritance tax to Revenue in Ireland. It is vital that you take the initiative to make this payment. Revenue puts the onus on the recipient of the inheritance to know what to do with their tax liability.

You can find all the information you need at revenue.ie but an expert advisor can help you with this also. There is an expectation that an inheritance tax is paid speedily and is not drawn out for a long period after the death of a parent or grandparent.

If you receive an inheritance between January and August of any given year you are expected to make a payment before October 31st of the same year.

How long do I have to pay my inheritance tax?

If the inheritance happens between Sept and Dec of a given year you are expected to pay the inheritance tax by August 31st of the following year.

Does Inheritance Tax have to be paid in one lump sum?

It is preferable to pay the entire amount in one go but there are options around deferment and split payments if required. You will need to discuss this with revenue to come to an agreement on payment schedules.

What time penalties are there for not paying in time?

If you are late paying your tax there is a late payment charge. If it is less than two months late you will be charged 5% of the total tax bill.

If you are later than two months then you will be charged 10%. There is an additional daily charge then levied until the payment is made.

Where can I make inheritance tax payments?

You can pay your tax bill online at revenue.ie

How to avoid inheritance tax legally?

You cannot entirely avoid Irish inheritance tax or gift tax legally. However, as this article has outlined, there are a number of ways in which you can reduce the impact of your tax bill.

By planning ahead a person can manage the transfer of their wealth by using small gifts as a way of gifting money to family members, a recipient can use the various tax reliefs for the types of inheritance properties and put expert knowledge to good use.

As an inheritance can be a life changing experience for many people it is vital that you allow the recipients to get the most benefit from it.

Estate planning is not an activity only for very wealthy people. Anyone who is a home owner and is in receipt of a company or other type of private pension has already amassed wealth that can be inherited.

By taking action now to manage your estate you are ensuring that future recipients of your estate will get the very most benefit from it.